На сайте используются cookie файлы

The site uses cookie files

Данный сайт имеет возрастное ограничение!

This site has age restrictions!

Я подтверждаю, что мне, увы, уже давно исполнилось 18 лет

Lotte Peplow, Brewers Association’s American Craft Beer Ambassador for Europe, outlines the latest trends in American craft brewing and looks at the fast-growing world of non-alcoholic beer.

Today’s craft beer landscape presents challenges on both sides of the Atlantic. In the U.S., shifting consumer habits, retailer rationalisation, inflation-driven cost pressures, tariffs, and unprecedented levels of competition are creating tough trading conditions for craft beer, according to the Brewers Association (BA), the not-for-profit trade association dedicated to small and independent American craft brewers.

But American craft brewers are nothing if not resilient and are stepping up to meet today’s challenges with adaptability and creativity. Here’s look at American craft beer by the numbers:

AMERICAN CRAFT BREWING TRENDS

Consolidation

Last year there was a continued democratisation and expansion of what it means to be a “brewer.” With acquisitions, mergers, and collaborations gaining ground, brewers are stepping up to meet today’s challenges head on by adjusting their offerings and, sometimes, their entire business models.

New Approaches to Hospitality

As consumers increasingly seek meaningful opportunities to connect, craft breweries are expanding their role as community “third spaces.” Whether through more substantial food offerings, an expanded range of beverage types, or more targeted programming, breweries are diversifying their revenue streams by appealing to specific consumer groups.

Growth in Low ABV

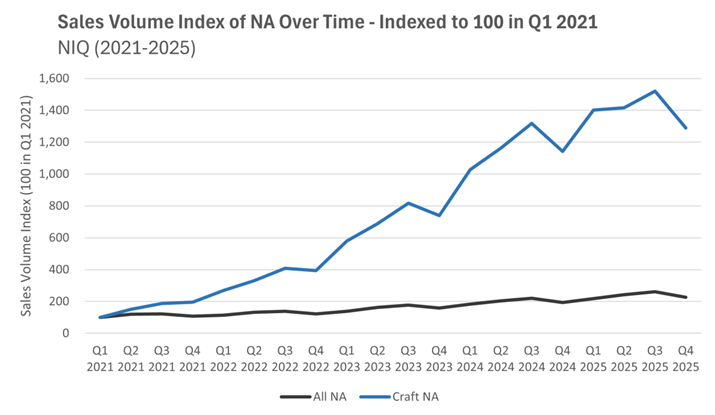

Non-alc continues to grow apace. While beer has been down low single digits, non-alc has experienced double digit growth in both dollar sales and volume. Although the sector accounted for just 2.5% of beer sales by volume in 2025, this share has more than doubled since 2021. In addition to non-alc’s continued growth streak, there has also been significant expansion in the low- to mid-strength segments (typically defined as <4.0% ABV). Brewers are seeking to capture more occasions that call for great flavour without the buzz.

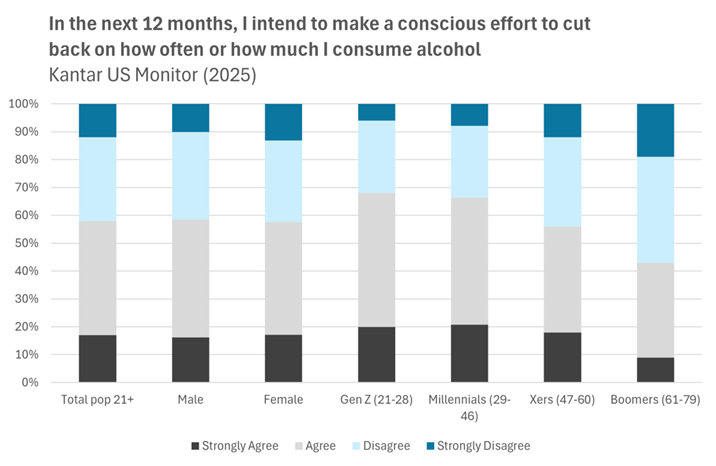

The majority of American adults in 2025 reported intent to cut back on alcohol consumption in the coming year (see chart below). Additionally, the Brewers Association’s latest Consumer Survey (conducted by Harris Poll) found that 14% of regular craft beer drinkers are consuming less craftbecause they’re drinking more NA. Within the industry, there’s an expectation that NA will be around for the long haul as 40% of Brewers Association newsletter survey respondents felt craft NA has staying power (compared to 31% who said it doesn’t).Consumers are looking to non-alcoholic options, whether full-time, for parts of the year, or for certain occasions.

And while much of this growth is attributed to existing NA producers (92% of volume in 2024-2025 came from NA brands launched prior to 2024), there’s no shortage of newcomers entering the space.

NIQ tracked 213 companies producing NA brands in 2025, up 134% from 2021 when there were just 91. It’s important to note that NIQ’s definition of Non-Alcoholic includes NA beer, hop water, NA cider, and NA cocktails produced by beer companies. It also does not include any NA brands produced and sold onsite at brewery taprooms (i.e. not at typical off-premise retailers). And while the number of companies has climbed over the past four years, the rate of brand growth has accelerated even faster.

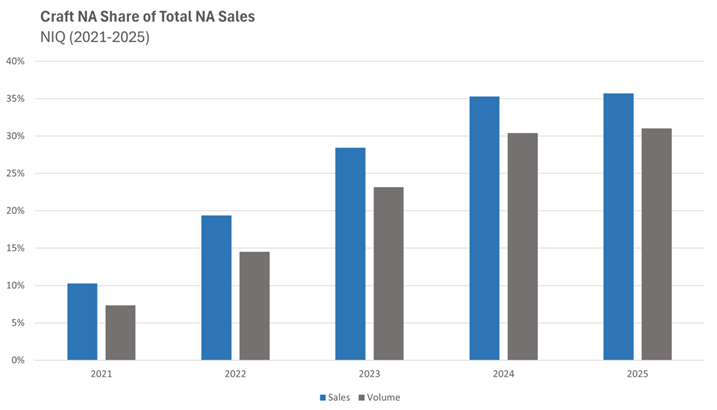

Non-Alcohol Craft

As shown in the chart above, craft NA is over-indexing in terms of sales and volume growth. It also represents the vast majority of growth in new NA producers and brands. All of this combined shows craft beer taking share of the NA category. In 2025, craft made up 31% of NA sales volume and 36% of NA dollar sales. That compares to craft beer’s roughly 13% share of beer overall.

What To Expect for NA in 2026

With so much momentum, continued growth looks likely in the year ahead. With more investment behind the category by large multinational brewers, we can expect overall sales to continue growing even if it means a slight drop in craft beer’s share of the pie.

One More Thing – Updated Beer Style Guidelines

In other news, the Brewers Association has released the 2026 Beer Style Guidelines with one new style addition: Rice Lager.

Rice Lagers have been growing in popularity as consumers trend toward lighter bodied, easier drinking options. While rice lagers aren’t new, craft brewers are putting their own spin on this familiar style by exploring the diverse flavours available from different rice varieties. These sessionable beers work especially well in warmer weather and pair nicely with rich or spicy foods.

The 2026 guidelines include particular attention to Belgian and German styles, with updates to better reflect both traditional brewing practices and how these styles continue to evolve.

U.S. Craft Beer in Ukraine

In Ukraine, American craft beer is available in Silpo or Good Wine stores.

Date for your Diary

America’s largest gathering for beverage alcohol producers, the Craft Brewers Conference & BrewExpo America (CBC®) will take place in Philadelphia, Pennsylvania, 20-22 April, 2026. This year’s conference will feature curated educational sessions and deliver a more streamlined program that better matches the needs of today’s beverage professionals while fostering a more structured conference experience. More info at Craft Brewers Conference.

_______________________

About the Brewers Association

The Brewers Association (BA) is the not-for-profit trade association dedicated to small and independent American brewers, their beers and the community of brewing enthusiasts. The BA represents 5,600-plus U.S. breweries. The BA’s independent craft brewer seal is a widely adopted symbol that differentiates beers by small and independent craft brewers. The BA organizes events including the World Beer Cup®, Great American Beer Festival®, Craft Brewers Conference®& BrewExpo America® and American Craft Beer Week®. The BA publishes The New Brewer® magazine, and Brewers Publications® is the leading publisher of brewing literature in the U.S. Beer lovers are invited to learn more about the dynamic world of craft beer at CraftBeer.com® and about homebrewing via the BA’s American Homebrewers Association® and the free Brew Guru® mobile app. Follow us on Facebook, Twitter and Instagram.

Issued on behalf of the Brewers Association, 1327 Spruce Street, Boulder, Colorado, 80302 USA. www.brewersassociation.org

For further press information: Lotte Peplow atlotte@brewersassociation.org +44 (0) 7973 698 414

⇒ Join our social networks ⇒ Optimistic D+ editors will take this as a compliment.

⇒ Every like is taken as a toast!