На сайте используются cookie файлы

The site uses cookie files

Данный сайт имеет возрастное ограничение!

This site has age restrictions!

Я подтверждаю, что мне, увы, уже давно исполнилось 18 лет

AWMB published the last decade’s monitoring.

Austria’s wine exports entered a new dimension in 2019. For the first time ever, exports surpassed the 180 million euro mark with a record 183 million euros (+8%), while volume shot up 20% to 63 million litres. The number of export countries rose to 102, in contrast to the 64 countries in 2009. As the latest figures from Statistics Austria show, the strong 2018 vintage in terms of volume fuelled exports in 2019. An 8% increase in revenue represented a new record of 182.9 million euros, while sales increased by 20% to 63.3 million litres. The volume of the 2018 harvest was approximately 15% higher than the 15-year average. This resulted in more wine being available in the entry-level price segment (sold primarily in price-sensitive markets such as Germany), which led to a drop in average price to €2.89 (2018: €3.22).

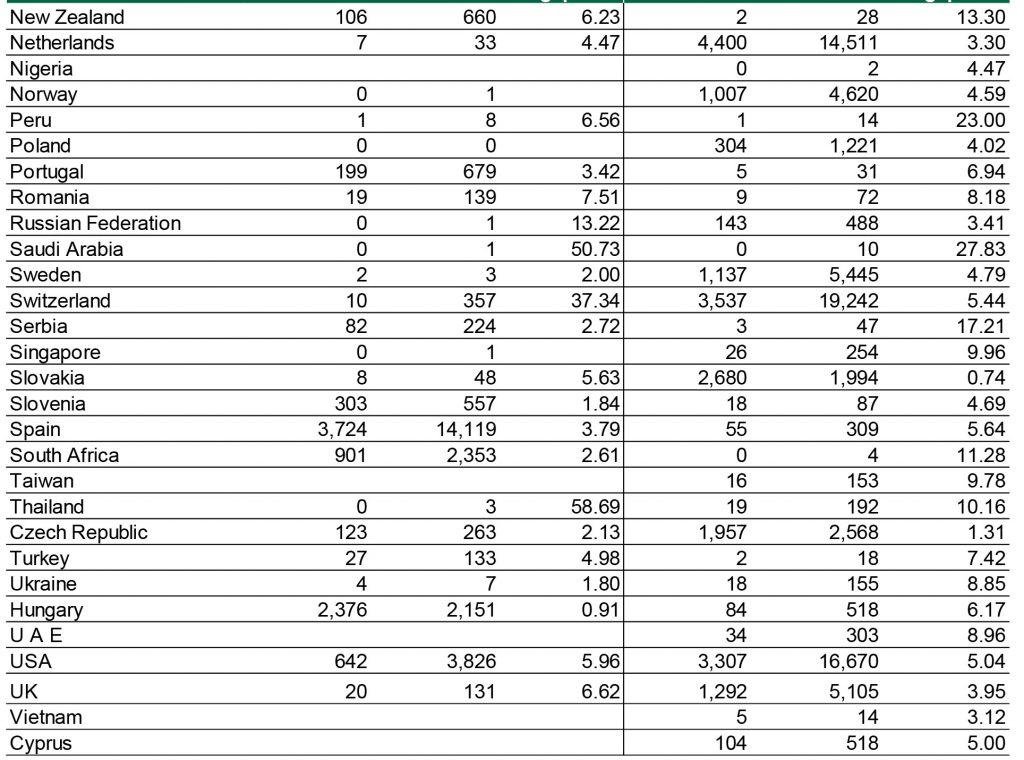

Alongside the leading export countries of Germany (+1.6%), Switzerland (+0.5%) and the USA (+14.8%), strong to very strong sales growth was also seen in the Netherlands (+31.6%) and throughout Scandinavia, with the exception of Norway. While the average price in Germany came under pressure, it continued to rise in many EU member states and third countries. In the Far East, the promising market of China recorded very high sales growth (+86.8%) and good growth (+12.6%) was also seen in Japan, after years of stagnation.

This increase in sales was primarily driven by Austrian white wine. In terms of revenue, bottled red wine grew remarkably well, which is testimony to the increasing recognition that the unique styles of Zweigelt and Blaufränkisch (to name but two) are attracting in the international marketplace.

*AWMB, based on Statistics Austria Final Export Data 2019; as at June 2020. Data from 2017 onwards is based on updated EU customs tariff numbers. The data capture method used by Statistics Austria includes re-exports of non-Austrian wine.

Domestic sparkling wine, on the other hand, suffered losses – with the exception of Norway and the United Kingdom, for example, which saw strong growth in Sekt imports. Semi-sparkling wine, on the other hand, showed a double-digit growth rate.

The growth in the number of export countries is also very encouraging: while Austrian winegrowers exported to 64 countries in 2009, this number reached 102 in 2019. For many years, the AWMB’s export strategy has been focused on positioning Austrian wine on a large number of international markets.

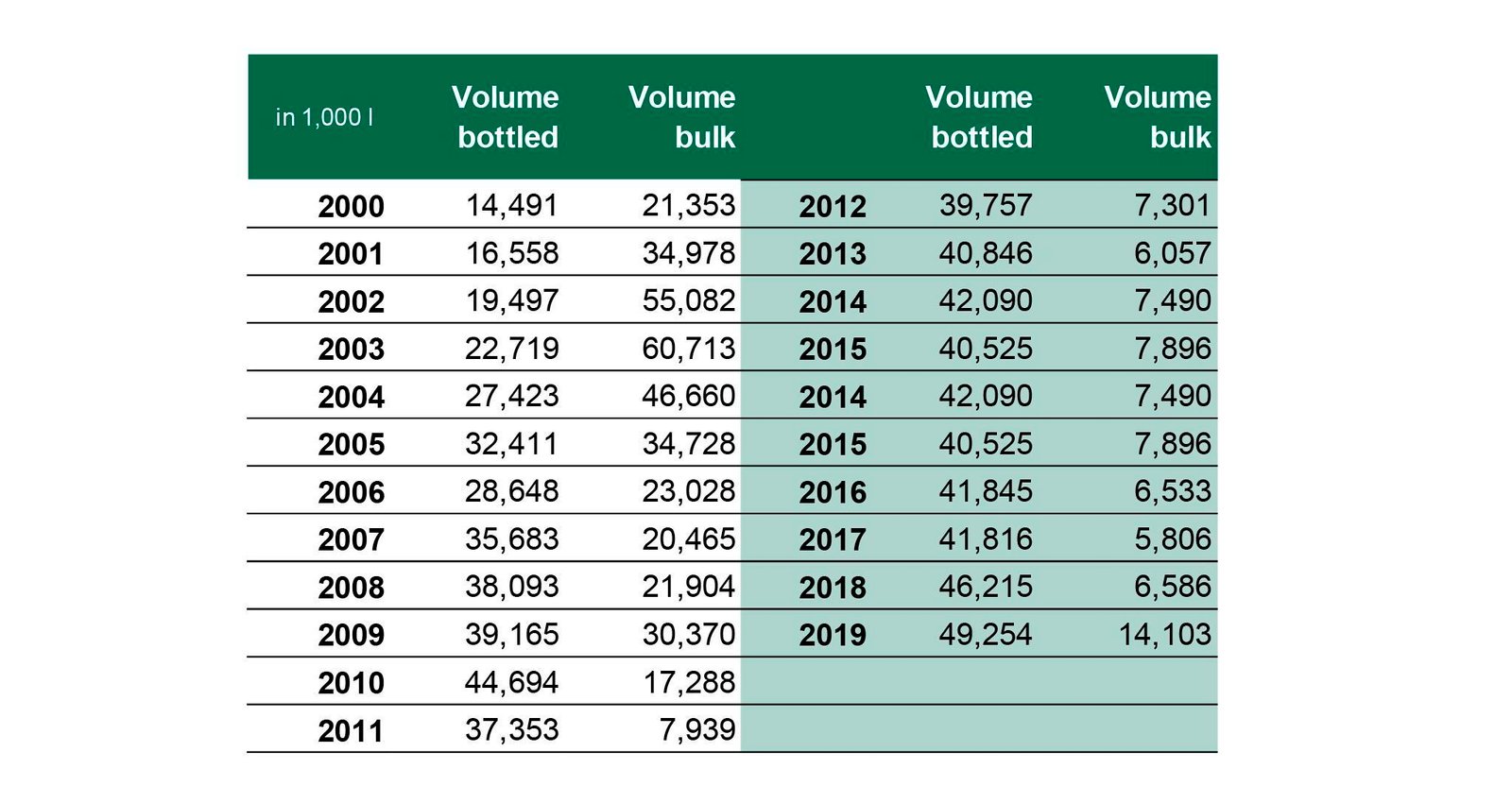

Volume share of bulk and bottled wine exports 2000-2019*

This strategy provides a buffer for fluctuations in individual markets while ensuring sustainable growth in exports overall. The share of exports represented by bottled wine amounts to 78% by volume and 94% by value. This development is of essential importance to the Austrian wine industry.

Since entering the EU, all Statistics Austria data relating to the EU have been based purely on statistical declarations by exporters and on Intrastat reports.

Intrastat declarations must be submitted by companies with imports or exports of goods from or to EU member states exceeding the assimilation threshold of €750,000 in the previous year. Small deliveries and exports in private cars are not captured. The reliability of the statistics is therefore not absolute.

Import and export volumes by country*

Sourse: AUSTRIAN WINE STATISTICS REPORT 2019, www.austrianwine.com, ©AWMB

Sourse: AUSTRIAN WINE STATISTICS REPORT 2019, www.austrianwine.com, ©AWMB

The lower threshold for the reporting requirement is different for each EU member state. The import figures fluctuate as a function of the high share of bulk in both volume and value terms, depending on the Austrian harvest. Conversely, for Austrian exports the share of bulk has dropped considerably, which has led to continuous increases in export values.

Based on AUSTRIAN WINE STATISTICS REPORT 2019, www.austrianwine.com, ©AWMB

Фото: ÖWM/Anna Stöcher