Увага! На сайті використовуються cookie файли.

The site uses cookie files

Даний сайт має вікове обмеження.

This site has age restrictions!

Я підтверджую, що мені, на жаль, давно виповнилося 18 років

The Drinks+ and Wine Travel Awards team has received an invitation to participate in the virtual ProWein Media Summit 2024.

This year, our media resources have once again taken on the role of Information Partner for ProWein, while ProWein actively participated in the WTA as its Exhibition Partner as well as we have now two nominees — the leading trade fair for the wine and spirits industry in the Chinese mainland, ProWine Shanghai and THE LARGEST AND MAIN PROFESSIONAL WINE AND SPIRITS FAIR IN THE AMERICAS ProWine São Paulo become a WTA nominee in the Magnet of the Region category, Enogastronomic Events nomination.

The Summit 2024 was started with the speech of Mr. Peter Schmitz, ProWein Director about the success of ProWein 30 years story: “The secret of success is simple and as always amazing. We have always seen ourselves as a partner of a wine and spirits industry. Recognize trends at an early stage, brining supply and demand together on the global scale. This is our recipe for success. Today ProWein turns 30 and its fulfil the special wish. We will have our own podcast studio which will be used for recording for all three days of the fair.”

As per Mr. Peter Schmitz, the organizers anticipate over 5,700 participants from approximately 60 countries, including a expanding array of spirits producers. Projections include 50,000 visitors from over 140 countries, with the presence of 937 media representatives from around the globe.

Presenting the Latest ProWein Business Report 2023: Available Now!

The second part of the Summit was dedicated to the ProWein Business Report 2023. On behalf of ProWein, Geisenheim University conducted its seventh annual survey in late 2023, polling experts spanning the entire value chain of the wine industry. Over 2,000 industry insiders worldwide participated, encompassing wine producers from key European and overseas wine-growing countries, exporters, importers, specialized wine merchants, and representatives from the food service/hospitality and hotel industries.

Prof. Simone Loose, Head of the Institute for Wine and Beverage Business at Geisenheim University, presented the result of the global industry barometer. “Consensus among industry experts suggests that the wine sector must tailor its communication strategies to meet the preferences of young consumers to effectively connect with the upcoming generation of wine enthusiasts. Additionally, ensuring the necessary profitability will entail a structural overhaul of global excess wine production,” says Prof. Simone Loose.

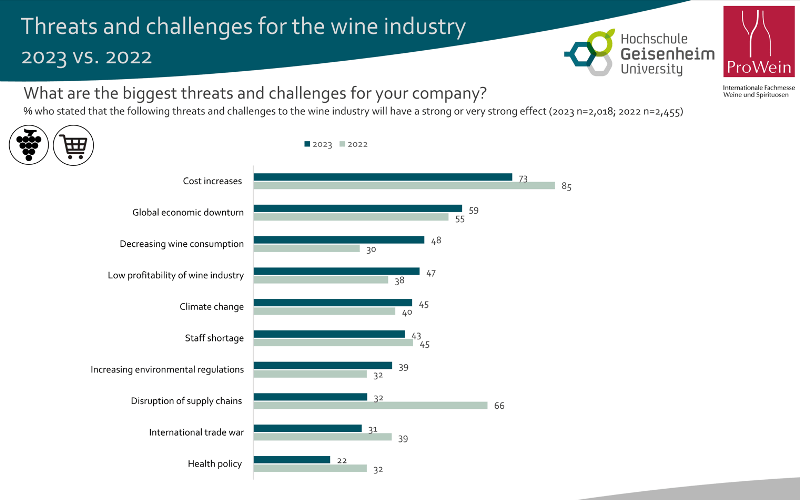

There were a few main topics according as cold regular “Marktbarometer” (Market Barometer). So, the first main topic was prevailing sentiment in the industry is characterized by economic challenges. Escalating costs and significant declines in purchasing power within private households are exerting a negative impact on the industry’s profitability. In response, companies are taking proactive measures to reduce costs and enhance sales. For 2024, the wine industry anticipates only moderate cost increases and maintains a cautiously optimistic outlook for the future.

The count of economic challenges has risen compared to the previous year, now leading the list with four indicators, albeit with a slight reduction in the risk of additional cost increases due to declining inflation. The global economic climate is still perceived as fragile. Notably, apprehensions about declining wine consumption and the limited profitability of the wine industry have markedly intensified – crucial aspects highlighted in this year’s ProWein Business Report.

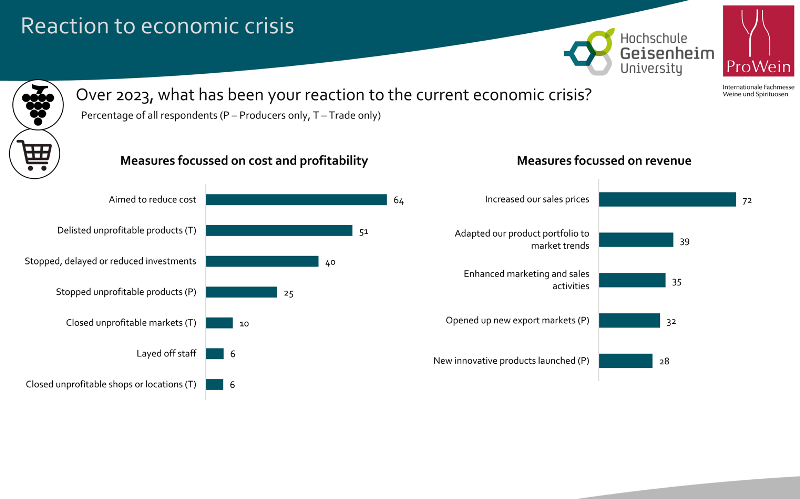

In response to economic challenges, businesses in the wine industry have implemented various entrepreneurial measures. A significant majority, comprising 72% of companies, attempted to offset some of the cost increases by raising prices. However, this strategy resulted in declines in sales, attributed to intense competitive pressure and heightened price sensitivity among consumers.

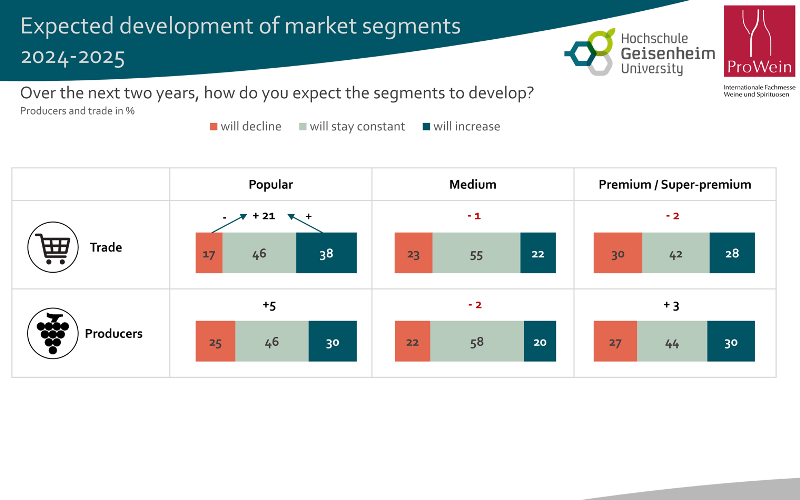

The second mail topic was Market Segment Dynamics. The trade industry is witnessing a robust shift towards popular market segments, with premium wines and the medium segments experiencing a decline. Trade experts anticipate an even more pronounced continuation of this trend in 2024 and 2025. Producers foresee a future polarization, expecting growth in both the basic/popular and premium segments.

In the absence of indications for economic recovery, the trade anticipates continued growth in the popular segment for 2024 and 2025, particularly prominent in Scandinavia and the Netherlands. Concerning the medium and premium segments, the proportion of merchants foreseeing a decline slightly outweighs those anticipating growth. Consequently, modest overall losses are expected in these segments.

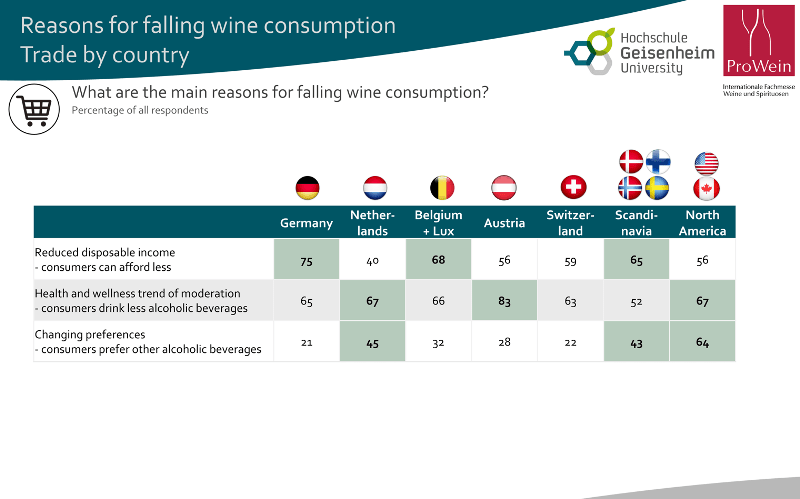

Topic three — Factors Behind Declining Wine Consumption. The primary cause of declining wine consumption is lower disposable income. Health and wellness trends contribute to a general reduction in the consumption of alcoholic beverages. In certain countries, there is a shift in preferences from wine to other alcoholic beverages.

The industry must exert considerable effort to leverage the health trend and advance alternatives, such as no-and-low alcohol wines, to reach technical and sensory maturity. This will establish them as authentic alternatives to traditional wines, recognized by both merchants and consumers. Following the No-and-Low Special in the ProWein Business Report 2023, a comprehensive update on this topic is scheduled for summer 2024. As the wine industry competes with other alcoholic beverages for consumer preference, there is also a need to align communication strategies more closely with their evolving needs.

Topic 4 — Strategies for Attaining Market Equilibrium. The wine market currently grapples with an imbalance stemming from excess supply. Producers emphasize the need to curtail this surplus supply. Many producers advocate for state support to facilitate this reduction. Optimism exists among some producers regarding the prospect of achieving a better balance through improved outreach to young consumers.

Topic 5 — Future Strategies for Wine Marketing. To compete effectively with other alcoholic beverages, the wine industry must enhance its targeting of young consumers. A consensus among industry experts is that wine needs to be more accessible and understandable for new target demographics. A subset of the industry envisions increased sales by positioning wine as an exclusive premium product. To align with other beverages in terms of marketing expenditure, wine must enhance its profitability.

You can find more information here.