Poland has never been, nor has it ever been perceived as, a wine country. But over the past few years, there has been a clear enhancement of interest in both viticulture and wine production.

The consumer interest in wine makes Poland the most important importer of this drink in Europe. Recently, the Polish alcohol market has been developing rapidly and, in the near future, it promises to become the most dynamic one in the world.

According to the Global Compass 2020 report, published by Wine Intelligence, Poland has climbed from the 14th line (attributable to 2019) to the fifth one – after the USA, South Korea, Germany, and China – in the list of the world’s most attractive wine markets.

A sharp spike in the rating can be explained by an increase in a number of the Poles drinking wine and an increase in income, which are taken into account when determining the attractiveness of the wine market, along with other economic and specific indicators. This makes Poland, which is a home to some 38 million people (the country ranked ninth in Europe in terms of population), the most important market on the continent.

Wine traditions

We often associate Poland with beer and vodka, which are attributable to this country’s long-standing tradition of consumption and production. But few people are aware that this country has its own winemaking culture.

The Poles began cultivating grapes and producing wine as early as in the 10th century. The first wineries were founded by Benedictine monks and wine was produced primarily for religious purposes. The grapes were cultivated in Silesia, Zielona Gora, Poznan, Torun, Plock, Sandomierz, Lublin, and Krakow.

In Poland, hybrid grape varieties were developed that are resistant to unfavorable climatic conditions. They are used along with international ones. The most popular are Rondo, Pinot Noir, Cabernet Cortis, Cascade, and Dornfelder. Although Poland has a continental climate, like the wine regions of Burgundy and the Loire Valley, Rioja, Piedmont and most of the vineyards in Austria, the Czech Republic and Slovakia, the climate here is characterized by significant seasonal and daily temperature fluctuations with frost in winter and hail in spring.

The cold climate, short summers with moderate and low temperatures produce grapes with a lower sugar content and higher acidity than those grown in southern Europe.

Polish asset: fruit wines

After World War II, Polish winemaking was developing in two regions: Western (Zielona Gora and Lower Silesia) and Central (along the Pilica River). However, the vineyards planted during the socialist era began to suffer losses, and in the 1960s, the Poles focused on the production of fruit wines.

In Poland, the term “wine” in due legal form includes the fermentation of not only grapes, but also other fruits and berries. The production of this kind of drinks dates back to the 13-th century. The most popular raw materials are apples (Poland is the largest apple producer in Europe and the third one in the world after China and the USA), but cherries, strawberries and raspberries are also often used to make wines. Therefore, in order to ensure that a consumer understands what product he or she intends to buy, the raw materials used (“apple wine”, “cherry wine”) must be indicated on the labels of the Polish fruit and berry wines. These drinks were very popular 20-30 years ago, and they were sold in the volumes of about 400 million liters per year.

The Renaissance era

In the 90s, the country created an image of wine as a luxury item that not everyone could afford. At the beginning of the new millennium, an important event consisted in Poland’s admission to the European Union. In 2004, there was an economic boom, and the free trade market began to develop actively. After 2008, there has been a dynamic growth of the Poles’ well-being, which has become a key driver of development of the wine market.

Over the past ten years, the local tradition of viticulture and winemaking has also revived, leading to the development of small vineyards making excellent wines for the local market. Whereas in 2009, there were 21 vineyards in Poland, nowadays, the number of registered vineyards in the country is 522! Their total area is 617.11 hectares.

D+ files

Today, in Poland, as in most countries of Eastern Europe, enotourism is actively developing. One of the region’s longest-operating media groups – Drinks + has established an international award for the development of wine tourism: Wine Travel Awards, and it invites wineries, guides, producers’ associations and wine routes’ representatives to take part in the contest (for more information, see here). In our opinion, an interesting experience (especially for the Ukrainian winemakers, who are in dire need of consolidation) is the precedent of uniting not only winemakers, but also brewers into one tourist route. The Lower Silesian Vineyard Association and the Lower Silesian Craft Brewers Association established the Lower Silesian Beer and Wine Route (Beer and Wine Droga), which now unites 17 vineyards and 16 breweries. Incidentally, promotion of this association is co-funded from the budget of the Self-Government of the Lower Silesian Voivodeship. Details: www.dspiw.pl.

The largest Polish vineyards:

- Zaborze (Lesser Poland Voivodeship) – 33.4 ha;

- Turnau (West Pomeranian Voivodeship) – 28 ha;

- Srebrna Gora (Greater Poland Voivodeship) – 26 ha;

- Jaworek (Lower Silesian Voivodeship) – 18.50 ha;

- Gostchorz (Lubusz Voivodeship) – 15 hectares;

- Silezian (Silesian Voivodeship) – 11 ha;

- Dembogura (Greater Poland Voivodeship) – 8 ha;

- Grudek (Podlaskie Voivodeship) – 8 ha;

- Stecov Family (Lesser Poland Voivodeship) – 7 hectares;

- Mierzęcin Palace (Lubusz Voivodeship) – 6.72 hectares.

Pallid statistics

According to the Central Statistical Office, the Polish wine market in 2018 was 240 million liters (wine from grapes – about 110 million liters, 30 million liters – flavored and fortified, and 90 million liters – fruit wines).

In 2018, 1.2 million liters were produced. More than 61% of the production output consists of white wines, because in the Polish climate, white varieties of grapes grow better. Producers are also investing their hopes in sparkling wines. It should be noted that a significant amount of cider has been available in the Polish market since 2013.

Poland is in the groove!

“National winemaking is rapidly changing its image,” – Marian Jezewski, wine market expert and president of the Enokultura association, says. “Polish wines have not enjoyed much consumer confidence for a long time, but the number of vineyards and wineries is growing and local wines are becoming more and more popular”.

Polish wines can be found in specialized shops, where a price per bottle sometimes reaches 25 euros. The representative of Drinks+ monitored the attitude towards local wine in the country. According to the distributors, these products no longer go stale.

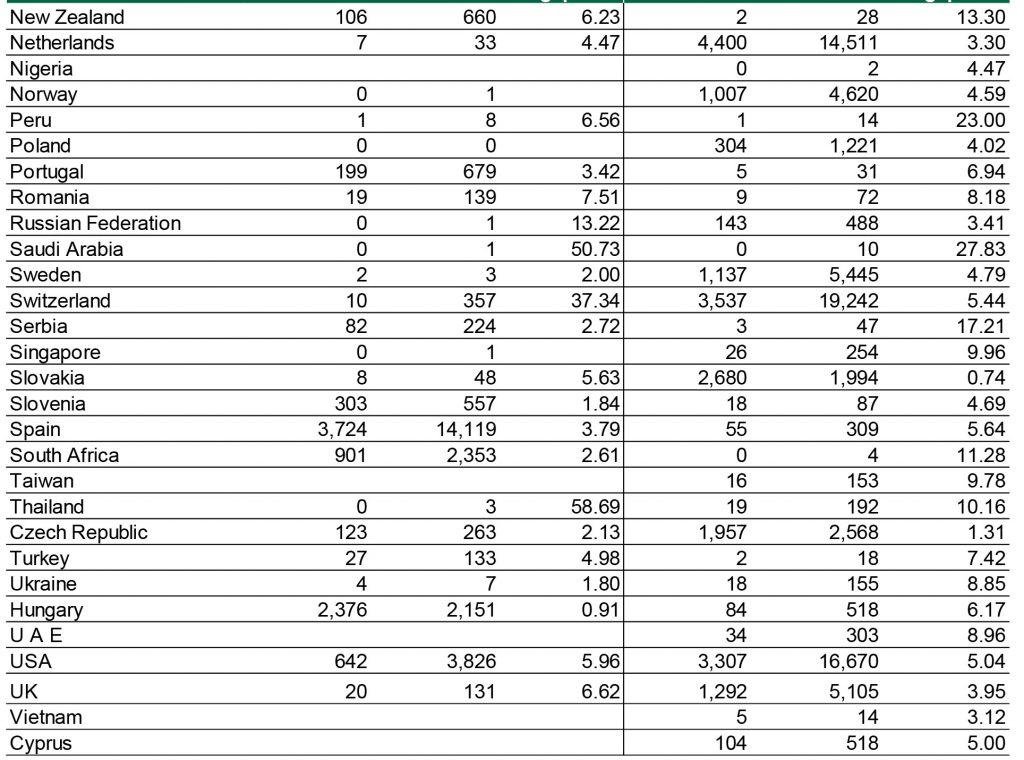

So, it looks like the modern Polish winemaking has started in the right place and at the right time. Reputable wine publications such as Wine Spectator and Wine Intelligence rank Poland as the world’s fifth most attractive wine market. Statistical data demonstrate (Wine Intelligence data) that 54% of the country’s population drink wine once or twice a week, 25% drink wine once or three times a month and 21% – once every two months (in 2015, such figures equaled 45%, 16%, and 39%, respectively). The share of wine is not the largest, it covers only 8% of the total alcohol market. But, for example, if you review the alcohol consumption issue only in Warsaw, here, the wine share is 25%. The largest wine importer is Italy, and the turnover with this country is estimated at 76 million euros.

And although consumption of wine in Poland per capita is still quite low – 4 liters per year, if we compare it with the wine’s per capita consumption in Germany or Great Britain, where the popularity of this drink is declining, we may see that Poland is in the groove.

This interest in wine is supported by a number of events. For ten consecutive years, the international wine competition GALICJA VITIS has been held in Poland (organized by the Foundation for the Development and Promotion of GALICJA VITIS Wines). The idea of this event is to develop wine traditions and establish contacts with wine-making countries in Europe, as well as to popularize wine culture in new wine countries. The GALICJA VITIS competition is also an excellent reason for promoting wines in the Polish market, which becomes more and more interested in such a proposal on the annual basis.

What and how do the Poles drink?

There is still a stereotype that Poland is a vodka-loving country. But in 1991 (after the collapse of the Warsaw Pact), everything began to change. Since then, the consumption of vodka is dropping significantly every year. Nowadays, most Poles drink beer.

According to the results of polls, wine is preferred mainly by representatives of the middle class, who are aged 25–45 years. Poles, unlike Italians and French, do not have the habit of drinking wine during the day. They drink wine when meet with friends on holidays or just at home, during dinner with a family. A tradition has emerged to send a bottle of wine along with an invitation to a wedding. More and more people in the country are drinking wine, mostly of high quality.

In Poland, they do not like excessively tannin and acidic wines; they prefer premium wines from the Italian variety Primitivo (Apulia) and Valpolicella wines, of which ripasso is the favorite one. Prosecco turned out to be the wine that significantly increased Italy’s share in the imported products.

Most often, Poles buy wine in shops. The average price per bottle bought in a supermarket is 15 zlotys (3.3 euros). In specialized stores, it is about 50–55 zlotys (12 euros), and in Warsaw, 65–70 zlotys (15 euros). Only 4% of the total share of wine (now, during the pandemic, it is even lower) is bought in restaurants and bars, since the markup there is significant and, accordingly, the price is high for many Poles. Note that the Poles are mentally similar to the Germans: they are very sensitive to prices.

Wine trends in Poland (Nielsen study)

- Wine in small bottles. Sales of wine in bottles with a volume of less than 0.38 liters accounted for 58%, and in bottles larger than 0.75 liters accounted for 9%.

- Non-alcoholic wine. The market for non-alcoholic wine has grown tenfold in the recent years. For example, non-alcoholic sparkling wine accounts for 0.4% of sales of the entire Polish wine market.

- Dry wines. The Poles give preference to a dry wine more and more often. The sweet wines positions are attributable to dry wines with a distinctive aroma. Sales of dry wines increased by 8% over the year, semi-dry and semi-sweet wines – by 4%.

- Prosecco dominates over champagne, which is understandable)). Sparkling wines are very popular in Poland, and prosecco sales reach one third of all sparkling wines (sales have grown by 57% over the last year).

Drinks+ recommendation

Winnica Pod Lipą

- Górzykowo 44 A, 66-131 Cigacice, Województwolubuskie

- +48 603 895 333, info@winnicapodlipa.pl

- www.winnicapodlipa.pl

The owners – Isabella and Zbigniew Tyliczak – named their facilities, including the vineyard, “Pod Lipą” (“Under the Linden”) due to a huge old linden tree growing on top of the vines-planted hill. This 0.5- hectare vineyard was founded in 2008.

In the favorable climate of the Odra River valley, at an altitude of 73 m above sea level, more than 2500 shrubs of noble varieties are grown: Riesling, Pinot Gris, Pinot Noir, Traminer, as well as Regent and Johanniter hybrids. In 2017, an up-to-date winery with a wine cellar was built. Pod Lipą winery produces wines from hand-selected grapes. Among the products of Isabella and Zbigniew Tyliszak are white wines – Riesling, Traminer and Johanniter, pinot gris, and red wines – pinot noir and regent, which are aged in oak barrels, as well as rosé wine from Regent variety.

Winnica Kinga

- StaraWieś 28, 67-100 Nowa Sól, Województwolubuskie

- +48 609 528 581, kinga@winnicakinga.pl

- winnicakinga.pl

Winnica Kinga is one of the oldest vineyards in Poland. It was founded in 1985. The owner, Mrs. Kowalewska-Koziarska, says: “Our vineyard is an enterprise created by several generations of a family, which is more than 30 years old”. Winnica Kinga’s vineyard area is 2 hectares. Main varieties: Seyval Blanc, Solaris, Muscat, Chardonnay, Regent, Zweigelt, and Pinot Noir. Each year, several types of Winnica Kinga wines are released in the market, and these are mainly blends. Currently, three wines of such type are produced: Remedium Alba 427, Remedium Rose 427, and Remedium Nigrum 427. Winnica Kinga wines are included into the List of Traditional Products of Poland, and most of them are sold directly at the winery.

Winnica Rajska

- Szczygla 8a, 42-300 Myszków, Województwo śląskie

- +48 518 057 417, winnicarajska@gmail.com

- winnicarajska.com

The family vineyard of Antoni Blaszak Winnica Rajska is located in Jura Krakowsko-Czestochowska near the Eagle’s Nest Trail. They had started winemaking here in the 90s, but only in 2016, they took it seriously, having planted on an area of more than 1.5 hectares, the varieties which are typical for local winemaking: Siegerrebe, Traminer, Riesling, Pinot Noir, Zweigelt, Johanniter, Solaris, Muscaris, Cabernet Cortis, Cabernet Cantor, and Regent.

In 2018, Antoni Blaszak had registered the vineyard, and a year later, he launched his first wines in the market.

Winnica Mozów

- Mozów 63, 66-100 Sulechów, Województwo lubuskie

- +48 660 493 034, kontakt@winnica-mozow.pl

- winnica-mozow.pl

Winnica Mozów is a family-owned company that recreates regional traditions. The vineyard was founded in 2007 by the great wine enthusiast and wine lover Robert Kukun. The vineyards were planted with vines, which are now used in Western and Central Europe. Currently, the vineyard occupies almost 4 hectares of territory, where the highest quality grapes are grown. Winnica Mozów produces unique wines: dry white Johanniter and Chardonnay, white semi-dry Pinot Gris, white semi-sweet Muscat, rosé semi-dry Pinot Gris and Muscat, red dry Cabernet Cortis, red semi-sweet Leon Millot, sparkling wines Johanniter and Chardonnay.

Text: Maksim Pobivanets, Sommelier, Educator of the Wine School Baku, WSET Level 2,3; Certified Diploma (Court of Master Sommeliers).

Poland has never been, nor has it ever been perceived as, a wine country. But over the past few years, there has been a clear enhancement of interest in both viticulture and wine production.