The war has become a challenge for all types of Ukrainian business. It has also influenced wine importers.

During the defence emergency, in 2022, the turnover of all types of alcoholic beverages, including products of the local wine market, sharply decreased. In January-June 2022, Ukrainians bought 58% less wine than in the same period in 2021. According to the results of 2022, the value of imported alcoholic and non-alcoholic beverages to Ukraine was USD 490 million. It is 32% less than in 2021*. The most significant decline in the wine market was related to sparkling wines. In January-April 2022, imports of sparkling wines in Ukraine decreased by 31% compared to 2021. However, in the same time, in 2023, this figure increased by 61% in volume and almost doubled in value. The closer we get to the Victory, the higher the demand for sparkling wines. In general, the volume of imports of sparkling wine from the key supplier countries in 2022 decreased in the following shares compared to 2021: Italy by 43.5%, Spain by 33.6%, France by 18.1%, Georgia by 68%, and Moldova by 46%. The main importers saw a decrease in the supply of sparkling wine as follows: Bureau of Wines 34.5%, Wine Hall 5.5%, ATB-Market 20.4%, Fozzy Group 65.9%, Bacardi-Martini Ukraine 46.3%, METRO Cash & Carry Ukraine 31.9%.**

Because of the negative consequences of russia’s full-scale invasion of Ukraine, large companies – importers, distributors, retailers – whose business is related to wine and high-proof alcohol experienced significant logistical difficulties. These changes prompted them to transform and optimise their business processes. One of the key challenges that Ukrainian companies had to face was wine logistics improvements, both on the foreign and domestic markets. In addition, from the beginning of the war, the government introduced a list of critical imports for about five months, which allowed limited cross-border foreign currency payments. Of course, there was no wine in this list… Wine logistics are now settling down, but there is a problem with the risks of paying for the goods. Many companies have switched to deferring payments for 30 days instead of 120, which leads to the search for additional payment resources and changes the principles of supply. Importers mainly import wines that sell faster.

Another pain for importers is that the occupiers are mercilessly destroying Ukrainian infrastructure, causing millions of euros in damage. For example, in May 2022, the warehouse of the wine importer and distributor Bureau of Wines, which owns Europe’s biggest wine store, GoodWine, was damaged. The losses amounted to about EUR 15 million. In August 2023, an enemy missile completely destroyed the FOZZY Cash&Carry hypermarket in Odesa – everything in the store burned down, with preliminary estimates of the damage reaching hundreds of millions of hryvnias. As for the forecasts, market experts hope that consumer indicators will be able to return to 2021 levels in about two years after the end of the war. D+ surveyed key importing companies. You can read about the changes in business during the war, the losses suffered by companies, and what helps them survive despite everything in the first-person comments.

*Data from the National Research Centre Institute of Agrarian Economics

**Analytics of AR-Group

Dmytro Saifudinov, Director of Vinfort LLC: “Plans for the coming year: to continue living and working in order to spite our enemies and please our friends”

How did your business change during the war?

Today, all our transformations or problems are the same as those faced by all Ukrainian businesses. I will try to list the main ones:

– Significant shortage of staff, mainly due to emigration. Unfortunately, some were killed on the front line.

– Range decrease – not all products remained as popular among the buyers, as they were before.

– Significant increase in selling prices: due to the increased prices set by the suppliers; growth of the cost of logistics, both domestic and international.

– Deterioration of terms of cooperation with many partners, both internal and external.

– Reduction of mark-ups to maintain more or less acceptable prices.

How did the volumes of deliveries and sales change? What factors particularly affected the decrease/increase in these indicators?

According to the 2022 results, the sales volumes fell by 30% in Hryvnias and by 40% in bottles, compared to the 2021 results. In the first half of 2023, there remains a significant drop in pieces, compared to the 2021 figure (40%) and a small drop in Hryvnias. The main factors behind the fall include closure of a large number of retail outlets, a continuous «prohibition», curfews, and, certainly, a significant increase in prices. As concerns deliveries, everything is simple: there had been no deliveries virtually until the 4-th quarter of 2022. This is due to the ban on imports, but even more to the unwillingness of foreign suppliers to make deliveries to the country at war.

Vinfort and partners. Chateau Magnol, Bordeaux, September 2023

Has the company’s price segment selection strategy in the procurement system changed? Can you give percentages of such changes by categories?

The procurement system has not undergone any significant changes. Undoubtedly, we are looking for products from a lower price segment, but we do not refuse the high segment ones, either. If analyzed by price categories, the 2021-2023 transformations are insignificant and are as follows:

– low-priced segment or segment of economy offers (low-priced): -12%. This segment has decreased significantly, mainly due to the transition of goods to a more expensive category:

– middle-priced segment: +11%. Actually, due to increase in prices for the low-priced goods.

– high-priced segment and premium segment (luxury). These segments virtually have not changed.

What changes has the import system in your company’s portfolio undergone, specifically: procurement channels, supplying countries, logistics routes, and warehouse storage arrangements (your own warehouses or those of your partners)? Can you estimate the increase in these processes’ cost and their impact on the company’s pricing policy for the end consumer.

The import system virtually has not changed. The warehouses were divided: we store a part of the goods in our own warehouse, and a part at our partners’ warehouse located in another city. The cost of storage and logistics did not affect the products’ prices significantly, though it did affect them.

What new trademarks of wines, strong alcoholic beverages, etc. appeared during this time in your company’s portfolio, what is their proportion by countries (kindly specify, at least, the first three)?

I presume that contracts with the producer of Irish whiskey Irishman (they changed the distributor in Ukraine), and with the wonderful Italian winemaker Castello di Bolgheri are among our biggest achievements of the last period. In addition, the range was expanded with the existing suppliers – wherever it was possible and expedient. Many brands had to be abandoned. Our cooperation ceased at least with those who did not want to/could not continue cooperating with us. It should be emphasized that the main part of the abandoned brands merely did not survive the competition, when moving to a more expensive price category.

How did the system of distribution (by regions, cities) and delivery of drinks to clients (ordering parties)/sale points change during the war? The number of partners, sale points has decreased, the percentage of HORECA or retail may have increased – please comment on the situation.

The market turned upside down. In other, calmer regions – if I may say so – we suffered a severe blow from the “prohibition”, which simply resulted in suspension of works. In addition, our sales are still being affected by the curfew. As concerns distribution system, in 2022, Transcarpathia (Zakarpattia) was the leader in terms of sales growth. Thereupon, the cities with the population equal to, or exceeding, 1 million people were gradually gaining the volumes back. Currently, everything has been more or less stabilized.

Nevertheless, the number of partners has decreased. We have not found a common language with some of the partners until now, and other partners have been far from behaving in a partner-like manner. We temporarily suspended cooperation with our long-standing partners from Mariupol, Kramatorsk. We are looking forward to their return. A large number of sales points were simply destroyed by the russians, and not all of them have resumed or will resume their operations.

HORECA have suffered significant losses, especially in Odesa, and sales in large shopping centers fell, too. Due to the risk of shelling of such places, people began to visit them less. On the other hand, e-commerce has grown significantly, in particular, via Rozetka: not only did it not stop its operations – in addition to Rozetka’s decent behavior at all times, as befits partners, it proved to be a real friend. A very reliable friend!

Despite the fact that some Ukrainian wineries have suffered greatly from the russian aggression, our winemakers are not giving up, and, according to our feeling, Ukrainian wines, are showing an increase in demand. Kindly provide us with the information on how distribution of the wine range (imported/local products) is changing and what goods prevail in the distribution: domestic or imported trademarks. Unfortunately, we do not possess accurate data, because we do not have time for this right now. The only thing we can say is that we are observing an increase in demand for Ukrainian wines, including against the background of a decline in sales of Moldovan wines, which are more or less in the same price category.

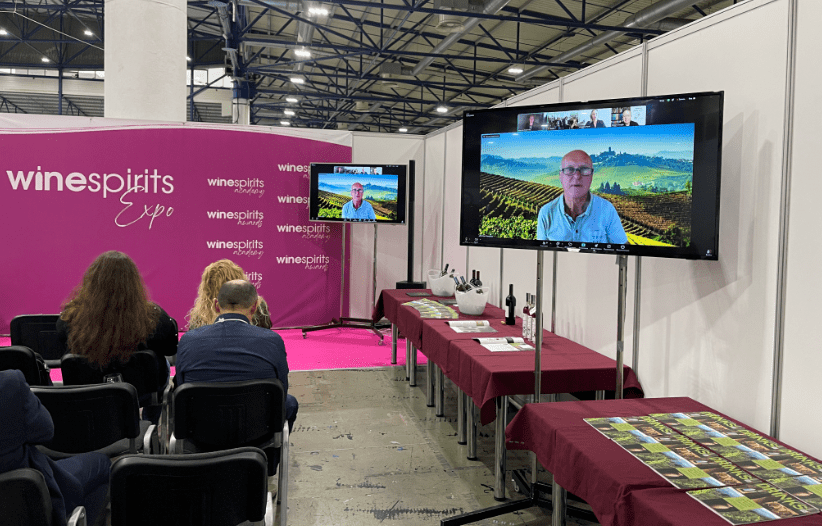

ProWein, March 2023

How do you assess the state tax policy in your sector during the war? Do you receive assistance or support in any form whatsoever from foreign partners?

The tax policy has not undergone any significant changes. We do receive assistance from many of our partners, in different forms, undoubtedly, and in different amounts. Even if an amount of such assistance is small, it still means that we have the support, we feel it – and that is very inspirational.

Has the company’s personnel reduced? Are you affected by the personnel shortage, ready to take the risks and invest into the personnel education?

Indeed, there is a shortage of personnel, and we feel that we are a bit understaffed. We invest into the personnel education, and we have always done that. It should be emphasized that today, it is even more important than ever: both for general development, and for distracting people from the everyday challenges.

Can you briefly comment on the current situation and your own plans for the coming year.

The current situation changes almost every day. By the time of this publication, I think that my comments will have been irrelevant. As concerns our plans for the coming year – we plan to continue living and working in order to spite our enemies and please our friends!

Nataliia Burlachenko, CEO of Big Wines (Ukraine), ambassador of Vinos de La Luz: “Our hearts belong to Ukraine!”

All Ukrainian businesses have undergone transformations since the beginning of a fullscale invasion. The alcohol prohibition during the first three months of the war, made no exception. The prohibition applied to sales, and if sales in your business are subject to veto, what consequences can be expected? In fact, they were disastrous. They also included reductions within the network, points of sale, and staff. Complete freezing of everything. It was hard. However, after the moratorium had been lifted, importers started moving, and the alcohol business revived. For us, the particularity of such moment consisted in the fact that we were planning to open our own company. We were preparing for this even before the invasion: we analyzed what directions could be covered, what the then current market dynamics was, what was happening, and what niche we could take.

Thus, the company Vinos de La Luz started its own importing business in Ukraine. Incidentally, this happened after we had launched our own brand of Ukrainian wine. At that moment, we realized that we were ready to enter the market independently with the brands of Vinos de La Luz. I would like to make an announcement: these will be primarily new names that have not yet been presented to the Ukrainian consumer. But I am sure that both wine lovers and professionals know and remember the quality of Vinos de La Luz wines. So we are proud to say that the style and level of quality is maintained in each of our new brands, regardless of the country of origin or how long the brand has been available in the market.

In fact, the owner of Vinos de La Luz – Dr. Ricardo F. Nunez – has long had plans to open his own production and import company here. The first project was launched in the form of a partnership. In the future, despite the beginning of the russian invasion, it was decided to continue working in the Ukrainian market. This is primarily due to the philosophy of Vinos de La Luz, which is based on the mission of supporting everything that is progressive. Secondly, the heart of Dr. Nunez, as well as our hearts belong to Ukraine. Well, thirdly, we reasoned that this war would end – God grant, shortly – and the Ukrainian market would become one of the most attractive: according to Ricardo’s forecasts, the donors’ funds would come to the country (here, we should recall the so-called Marshall Plan) and the economy would definitely start growing rapidly. Bearing that in mind, despite the war, we dared to start an import and export company. As you know, we have our own wineries in Argentina, Italy, Spain, the United States and now, of course, production facilities in Ukraine. It should be also emphasized that in 2023, in Spain, in Cigales region, Vinos de La Luz Group of Companies acquired another winery for white and rosé wines, and launched a new interesting project. Thus, we definitely have something to offer to the most demanding wine lovers, as well as something to demonstrate in the Ukrainian market: both new products and a selection of already well-known wines.

Incidentally, at the exhibition, which is to be held in Kyiv on November 1-4, you will be able to review a new portfolio of our company in Ukraine, which is called Big Wines. As I have already said, there will be wines from five countries. We are also expanding the line of Ukrainian wines. We already have Odesa Black of 2020 vintage, which is distinguished for having gained several gold medals at international competitions. Next year, we will bring Odesa Black of 2021 vintage to the market, and this will be a continuation of the artistic triptych in collaboration with the world-renowned Ukrainian artist Ivan Marchuk. Simultaneously, we are expanding the Ukrainian line of Big Wines: there will be wines not only from the flagship Odesa Black variety, but also from other Ukrainian varieties, on which we are focusing our attention, plus the wines made from international varieties. Our company’s portfolio is formed in such a manner that it has wines representing different price policies: from entry level to the premium segment. We try to anticipate any expectations and tastes of the Ukrainian consumers: some special limited series of Vinos de La Luz will be supplied only for the Ukrainian market, and, of course, our Ukrainian wines will also represent different price levels.

Regarding the conditions created by the state for business at the current stage, I would like to say that starting a company is not difficult and quite rapid. For example, it took only 10 days to have the license issued after submission of the required package of documents. It goes without saying that we plan to comply with all necessary rules and laws to conduct business openly and cooperate with all regulatory bodies – primarily because we care about the safety of our consumers and our reputation. We have proven temporally and territorially that we are honest taxpayers. This is now particularly important for all businesses. Payment of every hryvnia to the budget is a contribution to the Victory. You see, I have revealed our plans – we will be developing, increasing our portfolio, creating new jobs, and working on improving the culture of wine consumption. And we will be proving to our consumers that Ukrainian wines are absolutely competitive with the wines from other countries. Given that we are also a producing company in Ukraine, we are interested in promotion both in the domestic market and in export directions. We have felt a great interest in the Ukrainian wine in the world, and we want to stir up this interest in the future. Therefore, we plan to give a certain share of the portfolio to Ukrainian wines and distribute such wines in other countries through our distribution channels.

Our company is extremely proud that in these difficult times of the russian aggression against Ukraine, we are able to create jobs and pay salaries. And this is our mission for the future. Our development is, shall we say, triggered by the fact that we assume responsibility for Ukrainians by creating jobs, bringing back the people’s hopes.

Henkell Freixenet Ukraine LLC: “We are dreaming and planning!”

Oleg Kasianenko, Director. Valentyn Polyakov, Commercial Director

We faced a total ban on the shipping and sale of alcoholic beverages throughout 2022, especially the first half of the year. So it was a very difficult time. However, we didn’t give up. In the second half of the year, sales volumes began to grow. Of course, we do not talk about the eastern and southern regions of Ukraine, where the fighting and occupation continued.

What about sales volumes since the enemy invaded our country? In 2022, they have actually halved – compared to 2021. The supply of products has significantly decreased (in line with demand). I would also like to note that at the same time, our procurement strategy for the company’s price segment has not changed. However, there have been dramatic changes in logistics: transportation tariffs for some itineraries have doubled. Of course, this affected the price of products. Moreover, the cost of containers and packaging has risen too. On average, prices rose by 40-50%. In this situation, it seems logical that we did not change, and at least kept the existing brand portfolio. If we look at the map of our current business, we have to admit that we have completely lost sales in the occupied territories of the east and south of Ukraine. The regional offices barely work there.

The total number of trading partners has not decreased. In addition, there are more retail outlets and fewer HoReCa outlets. It can be explained by the situation in Ukraine and HoReCa’s working schedule. Based on the concept of our company, imported brands dominate the portfolio a priori. I should also note that, regardless of the current situation and the country of origin, traditionally, every year, our high-quality sparkling wines show positive dynamics during the New Year holidays. We are working to keep this trend maintained throughout the current period.

Now, in Ukraine, people say: «You can make plans no further than for today. More like today you can only dream». But we still feel our strength and the power of our brands, so we are not just dreaming, we, as always, are planning. Our company plans to continue developing sales in Ukraine. The immediate goal is to achieve a leading position in the country’s market in all segments of sparkling wines – prosecco and cava. And we are confident that soon Ukrainians will have a reason to celebrate, a reason to raise their glasses of sparkling wine.

Rozetka’s Press Office: “Currently, we are employing even more people than before the beginning of the enemy’s invasion”

The war accelerated changes in logistical processes: new warehouses appeared in more protected areas, security measures were significantly strengthened, and, giving due consideration to the respective situation, the marketplace sellers significantly expanded offers and opportunities for delivery of orders, etc. Currently, our volumes of deliveries and sales are increasing, partly due to the increase in a number of stores, as well as due to the exciting exclusive offers, loyalty price programs, etc.

On the import side, we are constantly looking for new interesting offers, and have been cooperating with the Ukrainian importers. As for our own imports, during the war, no producing country was rejected by us, except for Austria and Hungary, the promotion of which still requires some efforts on the part of our country, but it is the issue to be dealt with after the war, because at the current stage, we have to be attentive to the existing demand. We must state that the share of Georgian and Spanish wines has decreased.

Positive trends are also observed: thus, in the category “still wine/Ukrainian wines”, we have an increase of 6% compared to the relevant figure attributable to 2022, and 8% compared to the 2021 results. We even launched a new project with partners from Shabo: a new brand – VDOMA – entered the market; it has a great potential, and is already demonstrating good sales results.

On the sparkling wines side, we have achieved growth of + 5%, although we observe losses related to Georgia and Germany. As concerns our business map, the regions make significant contributions and their shares are growing; the number of stores has changed, and for clients, it is an opportunity to get their goods for free in their own region. Considering the current domestic shipping prices, this results in considerable savings. In addition, such opportunity saves time. We are also active in developing B2B channels.

We do feel support from many (almost all!) partners, suppliers (deferral of payments, messages of support, etc.). Currently, there are more employees working at Rozetka than before the beginning of the enemy’s invasion. We are constantly investing in training courses for the employees, and we plan to continue to do so even on a larger scale than now. We continue to develop our business despite all challenges, and plan to launch our own brands (including alcoholic ones), improve our service, and continue to be active in opening goods delivery points.

Today, every successful Ukrainian business is a contribution to the Victory. We do understand that, and have been working as a team in order to achieve this goal.

Olena Valevska, Commercial Director of ArtWine Company: “The most desired plan: to open a bottle of Dom Perignon on our Victory Day!”

Our company started working virtually six months before the war onset, so, unfortunately, we have no reliable representative analytical data yet. We are a small niche company that does only what it loves. We are professionals, who have gained extensive experience in working with the premium segment wines (we are not talking about [high] prices, in this case, “premium” refers to the lifestyle and values). We love these wines, we know how to work with them, so we understand their place in our market.

Even now, during the war, we do see the prospects, and do everything to ensure that Ukrainians have the opportunity to drink the best samples of the world’s wines.

Given the changes that have occurred in the market during these almost two years of the war, I can state that logistics costs have become very high, and we are forced to use the transportation routes under the contracts with all of our partners located outside Europe, through the ports of Poland. It should be emphasized that the situation is aggravated for us by the fact that almost everything we have, appeared after the war onset: in other words, we are currently at the stage of formation of our portfolio. Thus, without a shadow of a doubt, I can say that such portfolio formation period coincided with the most difficult times in the history of our state.

Bogdan Panchuk, brand ambassador of Wine Discovery Selection LLC: “We hope to recover the sales volume of imported wines and believe in the potential of the Ukrainian wine”

Currently, the number of our company’s employees has greatly decreased, and we are observing a significant drop in the sales of imported wines. In fact, we left only one supplying country, and we rejected the others. At the very least, we had to reject imports from Germany, Slovenia, and Spain due to re-fragmentation of sales channels, and a decrease in the purchasing power of consumers. In addition, the delivery time and the cost of logistics have increased significantly, but consumers of our products will not feel the increase in the costs of these processes, due to the fact that the price increase was only based on the exchange rate index. It should be noted that against the background of the import decline witnessed last year, our company has increased the sales of Ukrainian wines, which makes us very happy.

However, as concerns the current import-related situation, I should state that it has somewhat stabilized. At least the decline has stopped. The dynamics show a gradual increase. We hope to recover the sales of imported wines and believe in the potential of the Ukrainian wine.

Serhii Mazur, Director of Vitis Group: “We are launching a new project – production and distribution of the Ukrainian craft alcoholic beverages”

During the war, our business decreased by at least 50%, and the HoReCa sector was the most affected one due to the closure of restaurants. Nevertheless, the retail sales were least affected by the war’s negative impact.

However, a decrease in the volumes of deliveries and sales was caused by such factors as almost a doubling of the cost of logistics to Ukraine, which led to a 15-20% increase in prices, the overall growth of prices for the wines from Burgundy, the Loire Valley, Spain, and Argentina, as well as an increase of the cost of sparkling wines from Italy (a partial increase in prices by 15-20%), as well as by the exchange rate growth.

It should be noted that the share of wines in the mid-price segment increased by 10-15% in the portfolio, and the share of wines in the high-price segment also decreased. The range selection process was complicated due to the restrictions set on business trips (currently, the men of military age in our country are prohibited from traveling abroad). In addition, logistics chains from the New World through the port of Odesa have completely stopped. We are now organizing deliveries from the New World through Poland, which has led to a 50% increase in the logistics costs.

Our company also rejected the “Armenian Cognac” project due to the support of russia by the producing country. However, the share of Ukrainian wines in the portfolio has increased (subdistribution), but due to the wholesale prices increase, the Ukrainian wine brands have not yet attained the level of distribution that we would like them to attain.

Nevertheless, there is a trend towards increase in demand for high-quality domestic alcoholic beverages. I would like to emphasize that we are launching a new project: production and distribution of the Ukrainian craft alcoholic beverages (nalyvka, brandy, gin) throughout Ukraine and for export purposes. However, I need to recognize with regard to the state tax policy that the situation is characterized by an extremely negative attitude towards Ukrainian business in general. Particularly towards the alcohol importers: excise goods are not included into the category, to which the “inspection moratorium” applies. Often, there are no valid reasons for the inspections that are regularly conducted in the companies, and the sanctions imposed as a result of such inspections are prefaced by the phrase: “Go to court, then wait 3-4 years, and try to prove that the fine was not imposed lawfully”. Unfortunately, there is no presumption of innocence for entrepreneurs in Ukraine.

In addition, I would like to add that even at the outbreak of the war, our partners provided shelter to the forced migrants from Ukraine. We also appealed to our partners for donations, and are grateful to everyone who responded. Some of them paid contributions directly to the United24 Foundation, others made a charitable contribution in the form of goods, which are sold and respective sale proceeds are utilised to support other charitable foundations and institutions.

However, we understand that we should rely only on ourselves, and the main task at the current stage is to recover sales and regain positions in the market.

The war has become a challenge for all types of Ukrainian business. It has also influenced wine importers. During the defence emergency, in 2022, the turnover of all types of alcoholic beverages, including products of the local wine market, sharply decreased. In January-June 2022, Ukrainians bought 58% less wine than in the same period in […]